5 Common Bookkeeping Mistakes (And How to Avoid Them)

Accurate bookkeeping is essential for the health and growth of any small business. It helps you understand your financial position, make informed decisions, and stay compliant with tax regulations.

Many business owners struggle with managing their books because of time constraints, a lack of expertise, or relying on outdated methods. These mistakes may seem small at first, but can lead to cash flow issues, tax penalties, and even legal trouble over time.

In this guide, you will learn the 5 most common bookkeeping mistakes small businesses make and practical ways to avoid them. Whether you handle your own books or work with a professional, avoiding these errors can save time, money, and stress.

Why Bookkeeping Mistakes Happen

Many bookkeeping mistakes happen because business owners lack financial literacy or formal training. Without a clear understanding of accounting basics, it’s easy to make errors.

Some still rely on manual processes like spreadsheets or outdated software, which increase the chances of mistakes and data loss.

Time constraints also play a big role. Business owners often multitask and delay bookkeeping tasks, leading to rushed or incomplete records.

Lastly, there is a common misconception that bookkeeping can be fixed later at tax time. This approach can cause problems to pile up, making errors harder to spot and fix.

What Are the Most Common Bookkeeping Mistakes and How Can You Avoid Them?

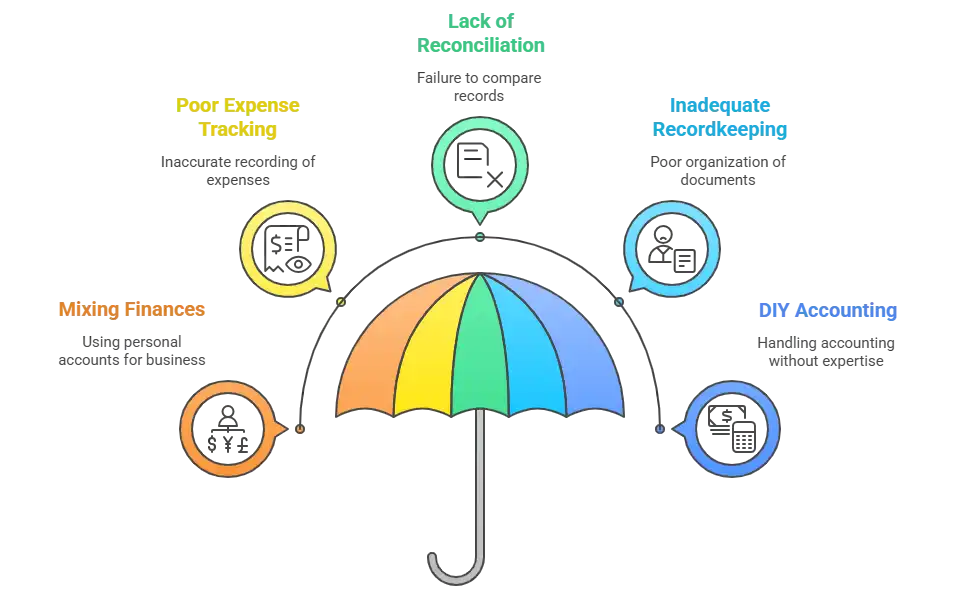

Bookkeeping mistakes can hurt your business’s financial health, but most errors happen for predictable reasons. Here are the 5 common mistakes and simple ways to avoid them:

Mistake #1: Mixing Business and Personal Finances

Many small business owners, especially at the start, use the same accounts for personal and business expenses. This leads to tax complications, messy records, and unclear profit tracking.

How to avoid it: Open a separate business bank account and use accounting software that automatically categorizes your business transactions.

Mistake #2: Failing to Track Expenses Properly

Lost receipts and delayed recording of expenses can cause missed tax deductions and inaccurate cash flow reports. This mistake makes it hard to know your true financial situation.

How to avoid it: Use expense tracking apps to capture every cost instantly, and set a weekly routine to enter all receipts and bills into your bookkeeping system.

Mistake #3: Not Reconciling Accounts Regularly

If you don’t regularly compare your bank statements to your bookkeeping records, errors like duplicate charges, forgotten payments, or even fraud can go unnoticed.

How to avoid it: Reconcile your accounts monthly or more often. Many software options offer automated alerts for mismatched transactions, making this task easier.

Mistake #4: Poor Recordkeeping or No Backups

Failing to organize and back up financial documents increases the risk of losing important files needed for taxes or audits. Hardware failures or accidental deletions can be costly.

How to avoid it: Switch to cloud-based accounting platforms that automatically save your data. Regularly back up your records and organize files by category and date for quick access.

Mistake #5: DIY Accounting Without Understanding Tax Laws

Trying to do your accounting without knowledge of tax rules can lead to misclassifying income and expenses, missing deadlines, and paying too much or too little tax.

How to avoid it: Schedule quarterly consultations with a professional accountant or bookkeeper. Stay informed about local tax laws and deadlines relevant to your business.

Essential Tips for Building a Reliable Bookkeeping System

Creating a strong bookkeeping system helps you avoid errors and stay on top of your finances. Here are some practical tips to get started:

- Choose the right accounting software: Tools like QuickBooks or Xero simplify tracking and reporting. They offer features such as automatic transaction categorization and bank feeds.

- Automate recurring entries: Set up automatic recording for regular transactions like rent, utilities, or subscriptions to save time and reduce manual errors.

- Maintain a month-end closing checklist: Create a checklist of tasks such as reconciling accounts, reviewing monthly reports, and verifying receipts to ensure nothing is missed.

- Train your team or outsource: If you have employees handling finances, invest in their bookkeeping training. Alternatively, consider outsourcing to professionals for expert management.

Final Thoughts

Catching and preventing bookkeeping errors early can save your business time, money, and stress down the road. Consistent systems combined with professional advice ensure your financial records stay accurate and reliable.

Take a moment to review your current bookkeeping habits and make improvements where needed. If you want expert help to streamline your accounting and stay compliant, consider working with trusted professionals like Suits Consultants.

FAQs

What are the most common small business bookkeeping mistakes?

Common mistakes include mixing personal and business finances, failing to track expenses properly, not reconciling accounts regularly, poor recordkeeping, and misunderstanding tax laws.

How do I know if I’ve made a bookkeeping error?

Signs include discrepancies between bank statements and your records, missing transactions, inaccurate financial reports, or unexpected tax issues.

Should I hire a bookkeeper or an accountant?

Bookkeepers manage day-to-day financial records, while accountants handle tax filings and financial strategy. Many businesses benefit from both, depending on complexity.

How often should I reconcile my accounts?

It is best to reconcile accounts monthly, but businesses with high transaction volumes may benefit from weekly or even daily reconciliations.