Why Monthly Bookkeeping Is Critical for Startup Success

Starting a business is exciting, but financially overwhelming. Between managing expenses, chasing revenue, and staying compliant, startup finances can quickly spiral out of control.

Without proper monthly bookkeeping, cash flow issues go unnoticed, tax deadlines get missed, and growth opportunities slip away.

In this guide, we’ll explain why monthly bookkeeping is critical for startup success and how it builds the financial clarity needed to scale with confidence.

What Is Monthly Bookkeeping and How Does It Work?

Monthly bookkeeping is the process of recording and organizing a business’s financial transactions every month. It helps track income, expenses, and cash flow so you always know where your money is going.

Each month, a bookkeeper reviews your bank statements, categorizes transactions, updates financial records, and prepares key reports like profit and loss statements. This routine keeps your finances accurate, up-to-date, and ready for decision-making or tax filing.

Why Bookkeeping Is Often Overlooked by Startups

Many early-stage founders overlook bookkeeping, thinking it’s either too simple or something they can handle later.

- Most startups focus on product and sales, leaving no time for regular financial tracking.

- Limited funds make hiring a bookkeeper feel like a luxury instead of a necessity.

- Many founders underestimate how complex business finances can get, even in the early months.

- DIY bookkeeping often results in missed entries, miscategorized expenses, or unbalanced books.

- Ignoring bookkeeping leads to tax filing issues, delayed payments, or unexpected cash shortages.

- Investors lose confidence when startups can’t present clear, up-to-date financial records.

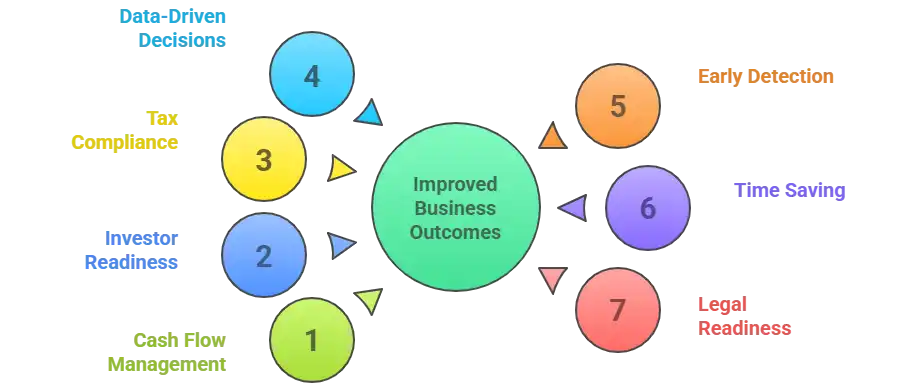

Critical Reasons Why Monthly Bookkeeping Drives Startup Success

Monthly bookkeeping helps startups stay financially organized, make better decisions, and avoid costly mistakes.

1. Improved Cash Flow Management

Tracking income and expenses monthly gives a clear picture of your cash position. It helps avoid overspending and ensures you don’t run out of funds unexpectedly.

2. Investor-Ready Financials

Consistent bookkeeping keeps your financials organized and accurate. This makes it easier to share reports with potential investors and build their trust.

3. Tax Compliance and Deductions

Well-maintained books help you file taxes correctly and on time. You can also track deductible expenses more easily and avoid penalties.

4. Data-Driven Decision Making

Monthly records give you reliable data for budgeting, forecasting, and planning. You can make decisions based on real numbers instead of assumptions.

5. Early Detection of Financial Red Flags

Regular bookkeeping helps you spot unusual spending, missing income, or errors early. This allows you to fix issues before they become bigger problems.

6. Time-Saving and Operational Focus

With updated books, you spend less time searching for receipts or fixing past mistakes. This frees up time for your main business tasks.

7. Legal and Regulatory Readiness

Accurate financial records are important when applying for loans, responding to audits, or meeting legal requirements. Monthly bookkeeping keeps everything in order.

Real-World Examples of Startups That Benefited (or Failed) Based on Their Bookkeeping Practices

Effective bookkeeping can significantly influence a startup’s trajectory. Here are two real-world cases illustrating this:

Success Story: Airbnb’s Strategic Pivot through Bookkeeping

In its early stages, Airbnb managed multiple ventures, including selling cereal boxes to fund operations. Through diligent bookkeeping, the founders identified that their home-sharing platform was the most profitable segment. This insight led them to focus exclusively on home sharing, a decision that propelled Airbnb into a multi-billion-dollar enterprise.

Cautionary Tale: Fresh Start 2020’s Collapse Due to Poor Bookkeeping

Fresh Start 2020, a labor hire company in North Geelong, Australia, collapsed under a debt of $1.23 million. An audit revealed that the company’s internal accounting software was poorly maintained, failing to accurately reflect financial transactions. This lack of accurate financial records led to significant underpayment of payroll taxes and ultimately, the company’s liquidation.

Monthly Bookkeeping vs. Quarterly or Year-End Accounting

Choosing the right bookkeeping frequency affects your financial clarity, decision-making, and risk exposure. Here’s how they compare:

| Aspect | Monthly Bookkeeping | Quarterly Accounting | Year-End Accounting |

| Frequency | Every month | Every 3 months | Once a year |

| Financial Visibility | Ongoing, up-to-date insight into income and expenses | Delayed, can miss monthly trends | Reactive, often after issues have already occurred |

| Decision Making | Informed and timely business decisions | Limited responsiveness to changes | Decisions based on outdated or incomplete information |

| Risk Management | Early detection of problems (cash flow, errors, etc.) | Issues may go unnoticed for months | High risk of major issues going undetected until too late |

| Tax & Compliance | Easier to track deductions and avoid penalties | More stress during tax season | Higher chance of missed deductions and compliance gaps |

| Cost vs. Benefit | More consistent effort, but saves money in the long run | Moderate cost, moderate clarity | It may seem cheaper, but it often leads to costly corrections |

What Should Monthly Bookkeeping Include for Startups?

Monthly bookkeeping isn’t just about recording numbers—it’s about keeping your startup’s finances organized and decision-ready. Here are the key components every startup should include:

- Bank Reconciliation: Match your internal records with bank statements to spot discrepancies and ensure accuracy.

- Accounts Payable and Receivable: Track what you owe and what you’re owed to maintain healthy cash flow and avoid payment issues.

- Monthly Profit and Loss (P&L) Statement: Summarize income and expenses to see if your startup is making a profit or running at a loss.

- Cash Flow Statement: Understand how money moves in and out of your business, so you can plan and avoid shortfalls.

- General Ledger Update: Keep the master record of all transactions current to support accurate reporting and auditing.

- Tax Record Updates: Organize receipts, invoices, and deductions monthly to stay prepared for quarterly or annual filings.

Final Thoughts

Monthly bookkeeping provides your startup with clarity, control, and confidence—key ingredients for sustainable growth. It’s not just a clerical task but a strategic practice that helps you make informed decisions, reduce running costs, and prepare for future opportunities.

Don’t let financial chaos hold your startup back. Take the first step today by partnering with Suits Consultants. Our expert team will handle your monthly bookkeeping accurately and efficiently, so you can focus on growing your business with peace of mind.

Contact Suits Consultants now and build the strong financial foundation your startup deserves.

FAQs

1. What is the difference between bookkeeping and accounting?

Bookkeeping involves systematically recording daily financial transactions, while accounting interprets and analyzes this data to provide insights and strategic advice.

2. How much does monthly bookkeeping typically cost?

Monthly bookkeeping services for small businesses typically range from $300 to $1,000, depending on factors like transaction volume and service complexity.

3. Can I use Excel for monthly bookkeeping?

Yes, Excel can be used for small-scale bookkeeping, especially with templates, but it may lack automation and scalability compared to dedicated accounting software.

4. When should I hire a professional bookkeeper?

Consider hiring a professional when bookkeeping becomes time-consuming, complex, or when you need accurate financial records for decision-making and compliance.

5. What happens if I don’t do monthly bookkeeping?

Neglecting monthly bookkeeping can lead to cash flow issues, tax complications, inaccurate financial reporting, and challenges in securing funding.